Robo-Advisors: Automated Investment Management

Finance and Investing

- John Quarrie

- October 1, 2023

In the rapidly evolving world of finance, technological innovation continues to reshape the landscape, making investment strategies more accessible, efficient, and even automated. Enter Robo-Advisors, the digital platforms that have transformed the traditionally human-centric domain of investment advisory into a streamlined, algorithm-driven service. At the heart of this revolution lies Automated Investment Management, a system where sophisticated algorithms, backed by decades of financial data and insights, make investment decisions on behalf of individuals.

These Robo-Advisors promise lower fees, tailored investment strategies, and minimal human intervention, offering a glimpse into the Future of personal finance. As we delve deeper into this topic, we’ll explore the mechanisms powering these platforms, their benefits, potential limitations, and how they stand compared to their human counterparts.

A Guide to Robo-Advisory: The Future of Personal Finance

1. Understanding Robo-Advisors:

In finance, Robo-Advisors represent one of the most transformative technologies of the 21st century. But what exactly are they, and how do they differentiate themselves from traditional financial advisors?

a. Definition and Function:

Robo-advisors are digital platforms offering financial advising services with little human intervention. Complex algorithms, often machine learning and artificial intelligence, fuel them to provide investment advice and automatically manage a client’s portfolio. By inputting specific financial data and personal goals, users receive tailor-made investment strategies optimized for their unique needs.

b. The Tech Behind the Scenes:

The real power of Robo-Advisors lies in the underlying algorithms. Drawing from vast financial datasets, these algorithms analyze historical market trends, investment patterns, and risk factors to create a balanced portfolio. Furthermore, as machine learning technology evolves, many Robo-Advisors can adapt and learn from new market information, refining their strategies.

c. User Experience:

For the end-user, the Robo-Advisor experience is typically characterized by simplicity. After answering questions regarding their financial status, goals, and risk tolerance, users are presented with an investment strategy. Most platforms also allow for easy portfolio performance tracking, automatic rebalancing, and even tax-loss harvesting, features traditionally reserved for high-end financial advisory services.

d. Cost Efficiency:

One of the standout features of Robo-Advisors is their affordability. By minimizing human involvement, these platforms can drastically reduce overhead costs. As a result, they often charge significantly lower fees than human advisors, making professional investment management more accessible to a broader audience.

e. Diverse Investment Vehicles:

Robo-advisors don’t just stick to stocks and bonds. Depending on the platform, they might invest in various assets, including ETFs (Exchange Traded Funds), commodities, or even real estate. This diversification, driven by algorithmic precision, ensures that the client’s portfolio remains balanced and in line with their specified risk tolerance.

2. Benefits of Robo-Advisors:

With their blend of advanced algorithms and user-friendly interfaces, Robo-advisors have ushered in a new paradigm in the financial world. The surge in their popularity is not without reason. Here are the key benefits that these automated platforms offer:

a. Cost-Effectiveness:

- Lower Fees: With minimal overhead costs due to reduced human intervention, Robo-Advisors typically charge significantly less than traditional financial advisors. This can translate to substantial savings for the investor over time.

- No Minimum Investment: Many platforms do not require a large initial investment, allowing even those with modest savings to start investing.

b. Accessibility and Convenience:

- 24/7 Availability: Unlike human advisors, who operate during business hours, Robo-Advisors are accessible anytime or night.

- Easy Onboarding: Setting up an account often involves a straightforward online questionnaire, making the process quick and hassle-free.

c. Customized Portfolio Management:

- Tailored Strategies: Based on an individual’s risk tolerance, financial goals, and other factors, Robo-Advisors generate customized investment strategies.

- Automatic Rebalancing: These platforms automatically adjust the distribution of assets in a portfolio to maintain an optimal balance, ensuring alignment with the user’s specified strategy.

d. Advanced Technology:

- Data-Driven Decisions: Using vast amounts of data and complex algorithms, Robo-Advisors make decisions rooted in extensive market research, historical trends, and statistical analysis.

- Adaptive Learning: Some advanced Robo-Advisors utilize machine learning to adapt and refine their strategies based on new market data.

e. Transparent and Educative:

- Clear Fee Structures: Fees are often clearly outlined, with no hidden charges. It empowers users to make informed decisions.

- Educational Resources: Many Robo-Advisory platforms provide educational content to help users better understand investing concepts, promoting financial literacy.

3. Potential Limitations:

While Robo-Advisors bring many advantages, they have drawbacks. Prospective users must be aware of these limitations before fully integrating them into their financial strategies.

a. Lack of Personal Touch:

- Generic Advice: Though Robo-Advisors tailor strategies based on user input, their advice can sometimes need more nuance and personalized touch than a human advisor might provide, especially in complex financial situations.

- Limited Emotional Intelligence: In times of financial stress or market downturns, human advisors can offer emotional support and context that an algorithm cannot.

b. Over-reliance on Algorithms:

- Algorithmic Errors: No system is infallible. If there’s a flaw in the underlying algorithm or if it operates on outdated data, it might lead to suboptimal advice or investment decisions.

- Inflexibility: While some Robo-Advisors use machine learning to adapt, many rely on static algorithms, which might only adjust slowly to sudden market changes or global events.

c. Limited Service Scope:

- Focused Offerings: Most Robo-Advisors concentrate on portfolio management and do not provide holistic financial planning services like estate planning, tax strategies, or retirement planning.

- Complex Financial Needs: Individuals with intricate financial situations or those needing specific advice on topics like real estate, business investments, or inheritance may find Robo-Advisors lacking.

d. Security Concerns:

- Data Breaches: Like any online platform, Robo-Advisors are susceptible to cyberattacks. A security breach could expose sensitive financial information.

- Operational Glitches: Technical glitches, software bugs, or platform outages can hinder access to funds or disrupt investment strategies.

e. Limited Human Interaction:

- Problem Resolution: While many platforms offer customer service, resolving complicated issues or misunderstandings might be more challenging without a dedicated human advisor.

- Complex Queries: Robo-advisors must be equipped to handle non-standard queries or clarify intricate investment topics.

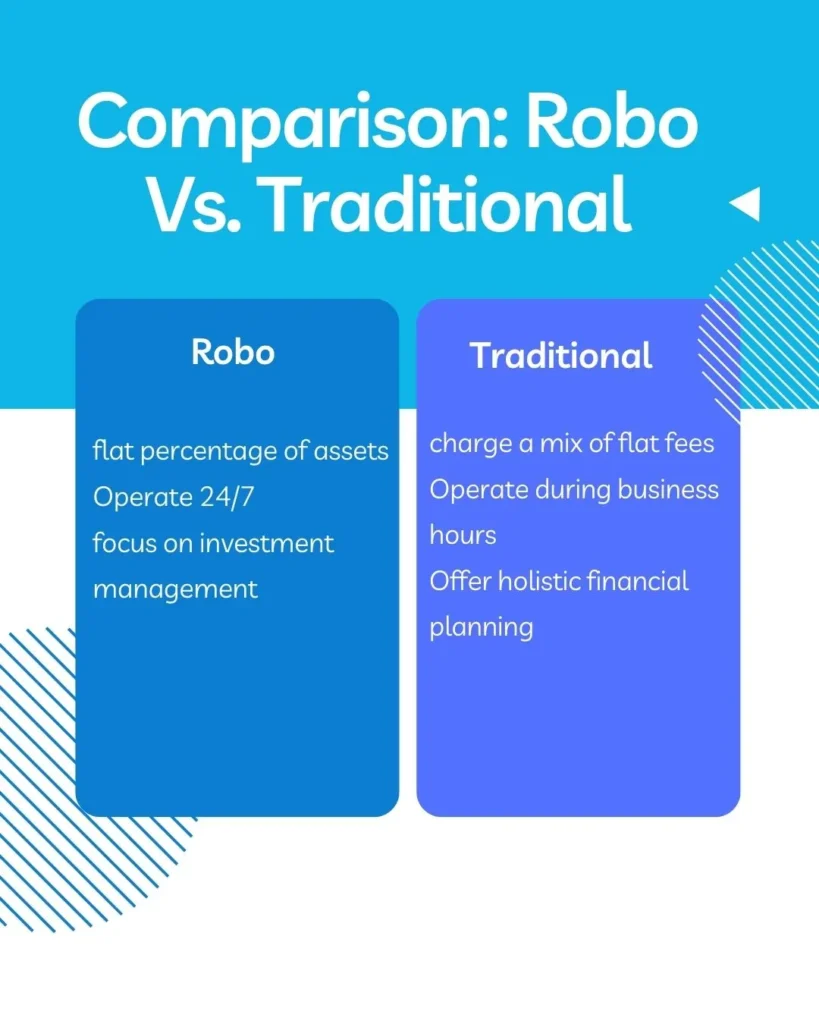

4. Comparison: Robo vs. Traditional:

Financial advising has also witnessed a tectonic shift as the world leans further into technological advancements. Robo-Advisors’ emergence has brought about a new way to manage investments, challenging the traditional role of human financial advisors. Here’s a side-by-side comparison to help you discern the differences and potential advantages of each:

a. Cost Structure:

- Robo-Advisors: Typically charge a flat percentage of assets under management, often considerably lower than human advisors. These reduced fees are attributed to their automated processes and minimized overhead costs.

- Traditional Advisors Might charge a mix of flat fees, hourly rates, or a percentage of assets. Their fees can be higher due to personalized services, office overheads, and other associated costs.

b. Personal Touch:

- Robo-Advisors: Offer standardized advice based on algorithms, which may lack a personal touch or deep understanding of unique financial situations.

- Traditional Advisors: Provide personalized advice tailored to individual needs, preferences, and situations. They can offer emotional support, especially during financial downturns or complex decisions.

c. Availability & Accessibility:

- Robo-Advisors: Operate 24/7, allowing users to access their portfolios and make changes anytime, anywhere, as long as they have internet access.

- Traditional Advisors: Operate during business hours, and meetings might require scheduling in advance. However, face-to-face interactions can lead to more in-depth discussions.

d. Scope of Service:

- Robo-Advisors: Mainly focus on investment management, using data-driven algorithms to manage and rebalance portfolios.

- Traditional Advisors: Offer holistic financial planning, covering a broader range of topics like retirement planning, tax strategies, estate planning, and more, based on an individual’s comprehensive financial picture.

5. Peeking into the Future:

The financial landscape has always been dynamic, constantly evolving in response to technological advancements, market demands, and global trends. Though a relatively recent innovation, Robo-advisors have made a significant impact quickly. As we peer into the Future, several trends and potential developments hint at the direction in which Robo-Advisory platforms might be heading:

a. Integration of Advanced AI and Machine Learning:

Robo-advisors will become even more sophisticated as AI and machine-learning technologies advance. This could mean better predictive analytics, understanding user behavior, and adapting investment strategies in real time based on global market trends.

b. Hybrid Models:

Recognizing the limitations of solely algorithm-based or human-based advising, the Future may see a rise in hybrid models. These would combine the efficiency and scalability of Robo-Advisors with the personal touch and expertise of human financial advisors.

c. Expansion of Services:

Robo-advisors might evolve beyond portfolio management to offer more holistic financial planning services, encroaching upon areas traditionally reserved for human advisors. This could include retirement planning, tax advisory, and estate planning.

d. Enhanced User Experience and Personalization:

As competition in the Robo-Advisory space intensifies, platforms might invest more in enhancing user experience. This could mean more intuitive interfaces, seamless integrations with other financial tools, and deeper personalization based on individual financial behaviors and preferences.

e. Focus on Financial Education:

With the democratization of financial services, there might be a more significant emphasis on educating users. Robo-advisors could offer many resources, tutorials, and interactive tools to improve financial literacy among their clientele.

f. Global Expansion and Localization:

As Robo-Advisors become more accepted worldwide, platforms might expand their reach to cater to global audiences, adapting their algorithms and interfaces to cater to local market conditions, cultural nuances, and financial regulations.

g. Security Enhancements:

With cyber threats becoming more sophisticated, Robo-Advisors of the Future will likely invest heavily in fortifying their platforms, ensuring data protection, and building user trust.

Conclusion:

Robo-advisors, the offspring of technological innovation and financial acumen, represent the next step in democratizing investment management. They provide a compelling proposition: making investing more accessible, cost-effective, and data-driven, a notable shift from traditional financial advisory practices. While they offer many benefits, from lower costs to 24/7 accessibility, it’s essential to recognize that they aren’t a panacea. The emergence of hybrid models, which blend the strengths of both Robo and human advisors, highlights the evolving nature of this space. It suggests a future where technology and human expertise coexist, complementing each other rather than competing.

In an ever-evolving financial landscape, the key for investors is to stay informed, adapt, and choose tools and services that best align with their individual needs, goals, and comfort levels. Whether you lean toward Robo-Advisors, traditional advisors, or a mix of both, the ultimate aim remains consistent: making sound financial decisions to secure a prosperous future.

FAQs:

1. What is a Robo-Advisor?

A Robo-Advisor is a digital platform that offers automated, algorithm-driven financial planning and investment management services with minimal human intervention. It typically requires users to answer a set of questions, and based on the responses, it allocates assets and manages the portfolio.

2. How do Robo-Advisors work?

Robo-advisors use complex algorithms and, in some cases, artificial intelligence to analyze a user’s financial situation and goals. They then recommend an investment strategy and manage the user’s portfolio, often automatically rebalancing it to align with predefined criteria.

3. Are Robo-Advisors safe?

Most reputable Robo-Advisors use advanced encryption and security protocols to protect user data. However, as with any online platform, cyber threats are always risky. Choosing platforms with strong security measures and regularly reviewing account activity is essential.

4. How do Robo-Advisors differ from traditional financial advisors?

While both aim to assist investors with financial planning and investment management, Robo-Advisors are digital, automated platforms that rely on algorithms. In contrast, traditional advisors are human professionals who provide personalized advice based on face-to-face interactions and a deeper understanding of individual financial situations.

5. What are the fees associated with Robo-Advisors?

Robo-advisors typically charge a percentage of the assets under management. These fees are generally lower than those of traditional financial advisors due to the automated nature of the service.

6. Can I trust a Robo-Advisor with complex financial situations?

While Robo-Advisors are designed to handle a wide range of financial scenarios, they might only be suitable for some complex situations or specialized advice that requires human expertise. In such cases, consulting a traditional financial advisor might be more appropriate.

7. Do Robo-Advisors consider tax implications?

Many Robo-Advisors offer tax-efficient strategies, such as tax-loss harvesting, to optimize returns. However, the extent of tax considerations might vary between platforms.

8. Can I adjust my investment strategy on a Robo-Advisor platform?

Yes, most Robo-Advisors allow users to adjust their risk tolerance and investment preferences, which can influence the algorithm’s portfolio recommendations.

9. Who are Robo-Advisors best suited for?

Robo-advisors are particularly beneficial for novice investors, those with straightforward investment needs, or individuals looking for a cost-effective way to manage their portfolios. However, they can cater to various investors with varying needs.

10. Will Robo-Advisors replace human advisors entirely in the Future?

While Robo-Advisors are gaining popularity, human advisors still play a crucial role, especially for clients who prefer personalized interactions, have complex financial needs, or seek holistic financial planning. The Future likely holds a blend of both, with hybrid models becoming more prevalent.

Reference sites:

If you’re looking for reputable reference sites related to Robo-Advisors and Automated Investment Management, here are some to consider:

1. Investopedia:

- Description: A comprehensive online financial education resource, Investopedia offers detailed explanations, articles, and guides about various financial topics, including Robo-Advisors.

2. CFA Institute:

- Description: A global association for investment professionals, the CFA Institute provides resources and research on various investment topics, including the evolving role of Robo-Advisors.

3. Financial Times – Wealth Management Section:

- Description: The Financial Times offers in-depth articles, news, and trends in the financial industry, including developments in the Robo-Advisor sector.

4. Morningstar:

- Description: A leading provider of independent investment research, Morningstar covers various aspects of the financial sector, including detailed reviews and analyses of Robo-Advisors.

5. The Robo-Advisor Pros:

- Description: A dedicated site for reviews, comparisons, and insights related to Robo-Advisors, offering readers a more in-depth look into this sector.

6. Wealth Management:

- Description: Covering the wealth management industry, this site provides articles and news about financial advising, including trends related to Robo-Advisors.

7. Betterment Resource Center:

- Description: As one of the pioneering Robo-Advisor platforms, Betterment offers a resource section with articles, insights, and research about automated investment management.

8. NerdWallet – Investing Section:

- Description: NerdWallet provides tools and advice to help people understand their options and make the best financial decisions. Their investing section has information and comparisons related to Robo-Advisors.

9. BCG – Boston Consulting Group:

- Description: BCG often publishes research and insights on the latest financial trends, including the rise and implications of Robo-Advisors.

10. Fintech Weekly:

- Description: Covering the latest fintech news, this site offers articles and research on various fintech sectors, including Robo-Advisors.