Creating a Business Plan for Successful Company Formation & Join companies that sell business plans, use them as our referrals, and write reviews

Business Strategies

Introduction

Embarking on the journey of company formation is akin to setting sail on uncharted waters, where a well-crafted business plan serves as the compass for success. A well-crafted business plan is more than just a piece of paper; it’s a road map that lays out a company’s future, complete with goals, tactics, and forecasts. This initial investigation dives into the critical nature of formulating such a strategy. It offers a fresh perspective by illuminating the opportunity to work with businesses that offer business plan services as a referral partner and share informative opinions.

To become successful, A well-structured business strategy is essential for long-term success in a global economy where competition is high and opportunities are plentiful. It offers:

- An outline of the strategy.

- A comprehensive analysis of the current market situation.

- Complete analysis of budgetary forecasts.

The business plan is the compass that helps a firm find its way toward its objectives and attract investors’ attention, gain key stakeholders’ support, and unite employees’ efforts.

A well-crafted business plan in the context of successful company formation

The Role of a Business Plan in Company Formation

To boost the growth and development of your business, you need an effective marketing plan. It’s like a roadmap that shows you the way and highlights the important milestones along the way to making your dream business a reality. A business plan is a document that outlines the overall purpose, direction, and objectives of your business. It provides a framework for entrepreneurs to make sense of the chaotic business world and move forward with confidence. A business plan can help you make informed decisions by detailing every aspect of your venture, from market research to operational strategies.

In addition, a strong business plan can be used to communicate your value proposition to investors, partners, and stakeholders. It demonstrates a deep understanding of your competitive landscape and risks. Customers are also more likely to buy from a company that has a clear and concise business plan. A business plan provides stability, structure, and direction for your business. It ensures that your growth trajectory is aligned with your desired goals. By outlining what needs to be done, a business owner can better prepare for challenges, seize opportunities, and adjust course as needed. This can lead to a more robust and successful startup.

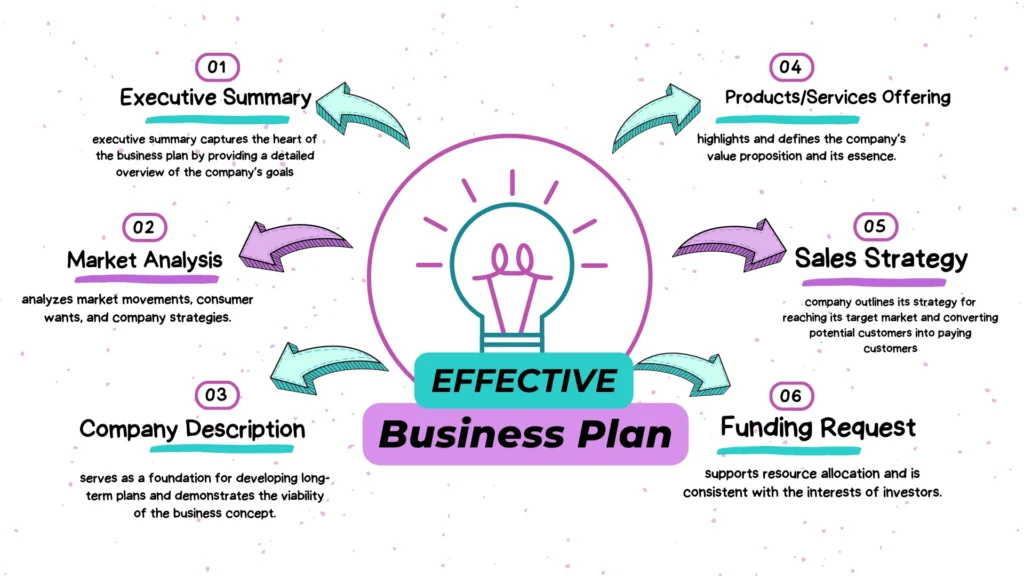

Critical Components of an Effective Business Plan

Developing a successful business strategy involves a number of factors that work together to steer the company in the right direction. Let’s discuss the importance of each factor in the grand scheme of things:

I. Executive Summary:

This executive summary captures the heart of the business plan by providing a detailed overview of the company’s goals, products or services, target market, and financial projections. It is the first opportunity for the company to make a good impression on potential investors and other stakeholders.

II. Market Analysis:

It is essential to get an accurate assessment of the market. This section analyzes market movements, consumer wants, and company strategies. It serves as a basis for creating long-term plans and demonstrates the strength of the business idea.

III. Company Description:

It is important to conduct a thorough market analysis. This section examines market trends, customer needs, and company strategies. It serves as a foundation for developing long-term plans and demonstrates the viability of the business concept.

IV. Products/Services Offering:

The company’s offerings and how they meet customer needs must be clearly defined. This section highlights and defines the company’s value proposition and its essence.

V. Marketing and Sales Strategy:

Here, the company outlines its strategy for reaching its target market and converting potential customers into paying customers. This is the first step in acquiring new customers and generating revenue.

VI. Organization and Management:

Important team members, their responsibilities, and areas of expertise are discussed below. It highlights the company’s shared expertise that drives its operations and strategic execution.

VII. Financial Projections:

The revenue, expenses, and profit projections are like a financial roadmap. This section evaluates the company’s potential for growth and financial sustainability for investors.

VIII. Funding Request:

If you want to raise money from outside sources, this section will lay out the sums needed and how they’ll be used. It supports resource allocation and is consistent with the interests of investors.

IX. Appendix:

Market research, legal agreements, and operational plans are supporting documents that add weight and legitimacy to the overall plan.

Crafting an Engaging Executive Summary

Your business plan’s executive summary is a powerful catalyst since it captures the core of your endeavor in a few short pages. It must convey an enormous impact in just 150 words. Create curiosity with a strong opening line, and then on to clearly explain your unique selling point. Describe the market potential you see, and highlight any major accomplishments you’ve made. Provide an overview of your financial forecasts, emphasizing revenue potential. End strongly by encouraging readers to delve deeper into the strategy. Even though it’s short, this overview is crucial since it invites potential backers and partners to learn more about your business and your ideas.

Conducting In-depth Market Analysis

Comprehensive market research is a critical tactical move for success in today’s fast-paced business. It takes a methodical investigation of the complete industry ecosystem to analyze a market. Finding out who you are attempting to reach and what their interests are is the first step. This understanding serves as the foundation for effective strategies. You may predict changes and take advantage of opportunities by being aware of present and future market trends.

Context is crucial, so a competitive analysis of the market is necessary. By exposing strengths, weaknesses, and market positioning, competitor research reveals chances for differentiation. You may develop a persuasive value proposition using this information. You might find probable future obstacles and disruptions by looking at economic and regulatory issues. Revenue models and long-term pricing strategies can be improved by analyzing market demand, supply dynamics, and pricing structures.

Building Realistic Financial Projections

Reliable financial forecasts are essential for a successful business strategy. They can help you make strategic decisions, demonstrate a well-planned growth path, and inspire both budgetary restraint and investor confidence. To produce reliable revenue estimates, you need to have a thorough understanding of market trends, anticipated demand, and the competitive environment.

When making a budget forecast, you also need to consider operational expenses, hiring, marketing, and overhead. It’s important to include room for unexpected events and fluctuations, which will make your forecast more reliable. Financial projections should include profit and loss statements, balance sheets, and cash flow projections. All of these elements work together to show how stable and profitable a business is.

A balanced forecast should show both growth and a cautious approach to risk management. Potential backers will look at budgets for feasibility and growth potential. Both overly optimistic and pessimistic forecasts can damage credibility, while the latter could discourage investment. Therefore, it’s important to find a happy medium between aspiration and reality.

Adapting the Business Plan for Different Audiences

Identifying the target audience is one of the most controversial aspects of business planning. There are those who believe a business plan should be geared towards just the owners and management team, whereas there are those who believe that it should be geared towards investors. However, the reality is that your business plan should appeal to much more than just these two audiences.

Adapting a business strategy to appeal to a wide variety of customers is a calculated move that will increase the impact of your messaging and help you make more genuine connections. Refining how you communicate with investors, partners, and lenders in today’s complex business environment may be necessary. The business plan’s relevance and resonance can be guaranteed by carefully targeting audiences.

Investors:

Potential investors should consider the company’s growth prospects, market opportunity, and financial return. Focus on the unique selling points, potential for growth, and anticipated profits. Highlight your competitive edge and unique selling offer to capture their interest.

Partners

Focus on the positive outcomes you can achieve by working together with your partners. Highlight how your shared goals and the partnership’s growth opportunities will benefit both parties. Demonstrate how their contribution contributes to the greater good.

Lenders:

Lenders place a premium on safety assessments and guarantees of payback. Make sure that your collateral, cash flow estimates, and ability to satisfy financial obligations are all highlighted in your business plan. Demonstrate that your financial plan and repayment method are sound.

Customers:

Although clients will likely review your company plan, it is nevertheless important that your marketing materials and product descriptions reflect the core concepts. Talk about how your goods and services will help and improve their lives.

Presenting Your Business Plan to Investors

Give a short, engaging presentation in which you introduce yourself, your firm, and the need, want, or desire that you intend to fulfil for your client. Tell them what you did to succeed and why they should put their financial investments in you. Your investor presentation needs to do more than relay information to persuade investors. Start by learning your plan through and out so you can confidently explain the details to others. Create a story that not only describes the benefits of your offering but also touches the hearts of potential investors.

Highlight your offering’s value proposition by explaining how it fills a specific void in the market. Provide solid evidence for your assertions by conducting a thorough market analysis that reveals your familiarity with the market and its dynamics. Share realistic yet aspirational estimates that support your development trajectory to paint a convincing financial picture. Use sincerity and enthusiasm to connect with your audience. Your energy and excitement can inspire others and set your business apart from the competition. Use graphics wisely if you want your audience to understand a complicated idea. Finally, show your flexibility and dedication to openness by answering questions and providing feedback gracefully.

Conclusion:

Developing a business strategy is more than just following a set of steps; it’s an adventure that requires forethought and careful preparation. The goals, research, and plans laid out here lay the groundwork for a successful business. It’s like a nautical chart for business owners, giving them a sense of where to go and how to expand their operations. Another example of the mutually beneficial potential of partnerships is the concept of forming referral partnerships with businesses that sell business plans. When business owners write reviews, they contribute to a community that helps other people considering a similar path make more well-informed choices.

These two stories meet in the middle of the fast-paced business world. When combined with strategic collaborations, a well-written business plan serves as a springboard for a new company’s debut in the market. The method exemplifies flexibility, perseverance, and dedication, which are highly valued in business.

FAQs:

1. Why is a business plan necessary for company formation?

A business plan serves as a roadmap for your company’s success. It outlines your goals, strategies, and financial projections, helping to attract investors and guide your growth.

2. What are the critical components of a business plan?

A comprehensive business plan includes an executive summary, market analysis, competitive analysis, marketing strategies, financial projections, and more.

3. How do I tailor my business plan for different stakeholders?

Customize your business plan’s emphasis and language based on your audience—investors, partners, or lenders. Highlight aspects that resonate with their interests.

4. What makes an executive summary engaging?

An engaging executive summary provides a concise business overview, showcasing its uniqueness and potential. Use compelling language and data to grab attention.

5. How do I conduct practical market analysis for my business plan?

Practical market analysis involves researching your target market, understanding industry trends, and identifying your competition’s strengths and weaknesses.

6. Why are realistic financial projections crucial in a business plan?

Realistic financial projections demonstrate your understanding of the market and your ability to manage finances, which enhances your credibility with investors and lenders.

7. How can I present my business plan to investors effectively?

When presenting to investors, focus on your company’s value proposition, growth potential, and the benefits of investing. Be clear, confident, and prepared for questions.

8. What are the differences between a business plan and a proposal?

A business plan outlines your company’s strategies and operations, while a business proposal focuses on a specific project, product, or service you’re offering.

9. How can I join companies that sell business plans as a referral to write reviews?

Look for companies that have referral programs in place. Reach out to them, expressing your interest in joining as a referral partner. Once accepted, you can review and promote their business plans to earn rewards.

10. What benefits do companies get from referral programs related to business plans?

Companies benefit from referral programs by expanding their customer base through word-of-mouth marketing. Referral partners help spread the word about their services, leading to more sales.

Reference sites:

1. Entrepreneur

2. Inc

3. Bplans

4. Investopedia

5. Score: Business Planning & Financial Statements Template Gallery

6. Cleverism: How to Create a Business Plan Step by Step

7. ReferralCandy: The Ultimate Guide to Referral Marketing

8. Neil Patel: How to Start a Referral Program

9. HubSpot: Referral Program Guide